The Federal Reserve’s recent decision to implement rate cuts has sent shockwaves through financial markets, triggering a substantial rally across multiple asset classes. This monetary policy shift represents a pivotal moment for investors, businesses, and the broader economy, creating ripple effects that extend far beyond Wall Street’s trading floors.

Understanding Federal Reserve Rate Cuts

When the Federal Reserve reduces interest rates, it essentially makes borrowing cheaper for banks, businesses, and consumers. This fundamental change in monetary policy serves as a powerful economic stimulus tool, designed to encourage spending, investment, and overall economic activity. The central bank’s primary objective through rate cuts is to maintain price stability while promoting maximum employment.

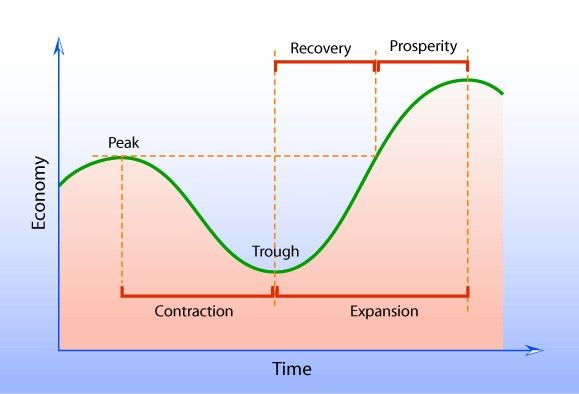

Rate cuts typically occur when economic indicators suggest slowing growth, rising unemployment, or deflationary pressures. By lowering the federal funds rate, the Fed aims to inject liquidity into the financial system, making credit more accessible and affordable. This mechanism encourages businesses to expand operations, hire additional workers, and invest in new projects, while simultaneously motivating consumers to make purchases they might have previously postponed.

The transmission mechanism of monetary policy works through various channels. Banks reduce lending rates for mortgages, business loans, and credit cards, making financing more attractive. Lower yields on government bonds drive investors toward riskier assets like stocks, real estate, and corporate bonds, seeking higher returns. This portfolio rebalancing effect often leads to significant market rallies as capital flows into equity markets.

Market Response to Recent Rate Cuts

The immediate market response to Fed rate cuts has been overwhelmingly positive, with major stock indices posting impressive gains across multiple sessions. Technology stocks, which are particularly sensitive to interest rate changes, have led the charge higher as lower discount rates increase the present value of their future cash flows.

Growth companies benefit disproportionately from rate cuts because their valuations rely heavily on future earnings potential. When interest rates decline, the mathematical models used to value these companies assign greater worth to projected profits years into the future. This valuation boost explains why growth-oriented sectors often outperform during periods of monetary easing.

Financial markets have witnessed broad-based participation in the current rally, with sectors ranging from consumer discretionary to industrial companies posting significant gains. Small-cap stocks have particularly benefited, as these companies typically carry higher debt loads and face greater financing challenges during periods of elevated interest rates.

The bond market has also responded favorably, with longer-duration securities experiencing price appreciation as yields declined. This inverse relationship between bond prices and yields creates opportunities for fixed-income investors while simultaneously pushing yield-seeking capital toward dividend-paying stocks and real estate investment trusts.

Economic Implications of Lower Interest Rates

Beyond immediate market reactions, Fed rate cuts carry profound implications for economic growth and stability. Lower borrowing costs stimulate business investment in equipment, technology, and infrastructure, creating a multiplier effect that benefits employment and productivity growth.

Consumer spending typically receives a boost from rate cuts through multiple channels. Existing homeowners with adjustable-rate mortgages see immediate payment reductions, freeing up disposable income for other purchases. Credit card rates decline, making financing more attractive for major purchases. Additionally, refinancing activity increases, allowing homeowners to reduce monthly payments or extract equity for spending or investment purposes.

The housing market responds particularly sensitively to interest rate changes. Lower mortgage rates increase affordability, expanding the pool of qualified buyers and typically leading to increased home sales and price appreciation. This housing market stimulation creates positive wealth effects for existing homeowners while supporting construction employment and related industries.

Corporate America benefits from reduced financing costs across the board. Companies can refinance existing debt at lower rates, reducing interest expenses and improving profitability. New project financing becomes more attractive, encouraging capital expenditures that drive economic growth. Merger and acquisition activity often increases as the cost of financing deals decreases.

Investment Strategies During Rate Cut Cycles

Savvy investors recognize that Fed rate cuts create distinct opportunities and challenges that require strategic portfolio adjustments. Understanding historical patterns and sector rotations can help optimize returns while managing risks during these monetary policy shifts.

A. Equity Sector Allocation

Growth stocks historically outperform during the early stages of rate cut cycles. Technology companies, biotech firms, and emerging growth businesses benefit from improved valuations as lower discount rates increase the present value of future cash flows. Investors often reallocate capital from defensive sectors toward these growth-oriented opportunities.

Financial sector performance becomes more complex during rate cuts. While lower rates compress net interest margins for banks, reduced credit costs and increased lending volumes can offset margin pressure. Regional banks often underperform initially but may recover as economic conditions improve and loan demand increases.

Utilities and consumer staples, traditionally defensive sectors, may underperform as investors rotate toward more cyclical opportunities. However, dividend-focused strategies within these sectors can still provide steady income streams and portfolio stability.

B. International Diversification

Rate cuts often weaken the domestic currency, making international investments more attractive from a dollar-based perspective. Emerging market equities frequently benefit from improved capital flows as investors seek higher yields and growth prospects. Developed international markets may also gain as currency effects enhance returns for domestic investors.

Commodity investments often perform well during periods of monetary easing. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, while economic stimulus expectations support industrial metals and energy prices. Real estate investment trusts benefit from both lower financing costs and increased investor appetite for yield-generating assets.

C. Fixed Income Positioning

Bond portfolio management becomes crucial during rate cut cycles. Longer-duration securities typically outperform as yields decline, but investors must balance duration risk against reinvestment risk. Corporate bonds often outperform government securities as credit spreads tighten and default risks decrease.

High-yield bonds may experience significant outperformance as improving economic conditions reduce default concerns. However, investors must carefully evaluate credit quality and avoid reaching for yield in lower-quality issues. International bonds can provide diversification benefits and currency exposure advantages.

Risks and Considerations

While Fed rate cuts generally support market rallies, investors must remain cognizant of potential risks and unintended consequences. Monetary policy changes create both opportunities and challenges that require careful navigation.

Asset price inflation represents a primary concern during extended periods of low interest rates. Excessive liquidity can drive asset prices beyond fundamental values, creating bubble conditions that eventually require correction. Real estate markets, in particular, may experience unsustainable price appreciation that ultimately proves problematic.

Currency devaluation risks emerge when rate cuts significantly diverge from international monetary policies. A weakening domestic currency can boost export competitiveness but also increase import costs and inflation pressures. International investors may reduce exposure to domestic assets if currency depreciation offsets investment gains.

Income investors face significant challenges in low-rate environments. Traditional fixed-income investments provide reduced yields, forcing retirees and conservative investors to either accept lower income streams or increase risk exposure. This yield compression can create difficult portfolio management decisions.

A. Inflation Considerations

Prolonged periods of monetary accommodation can eventually lead to inflationary pressures. While initial rate cuts may coincide with deflationary concerns, sustained stimulus can overheat the economy and trigger unwanted price increases. Investors must monitor inflation indicators and position portfolios accordingly.

Food and energy prices often respond quickly to monetary stimulus, creating immediate cost-of-living pressures for consumers. Wage inflation may follow as labor markets tighten, potentially forcing the Federal Reserve to reverse course more aggressively than initially anticipated.

B. Market Timing Challenges

Attempting to time market movements around Fed policy changes presents significant challenges even for professional investors. Markets often anticipate policy changes well in advance, incorporating expected rate cuts into asset prices before official announcements. Late investors may find limited upside potential after rallies have already occurred.

Policy reversal risks require constant monitoring. If economic conditions improve more rapidly than expected, the Federal Reserve may halt rate cuts or even begin raising rates sooner than markets anticipate. Such policy pivots can trigger sharp market corrections and catch unprepared investors off-guard.

Historical Context and Precedents

Examining previous Fed rate cut cycles provides valuable insights into potential market behavior and economic outcomes. Historical analysis reveals both consistent patterns and unique circumstances that shaped different episodes of monetary easing.

The 2008 financial crisis prompted aggressive rate cuts that ultimately supported one of the longest bull markets in history. However, the initial market response was negative as investors focused on the underlying economic problems necessitating such dramatic policy action. Only after stabilization became apparent did markets begin their sustained rally.

The dot-com bubble burst in 2000-2001 led to rapid rate cuts that helped cushion the economic downturn but also contributed to the housing bubble that emerged later in the decade. This historical example illustrates how monetary policy solutions can create new problems if maintained too long or implemented too aggressively.

More recent examples include the European debt crisis response and COVID-19 pandemic policies. Each episode demonstrates how rate cuts interact with other economic factors and policy measures to create unique market dynamics and investment opportunities.

Future Outlook and Market Expectations

Current market expectations suggest continued monetary accommodation in the near term, with investors pricing in additional rate cuts based on economic data and Federal Reserve communications. However, the path forward remains uncertain and dependent on evolving economic conditions.

Economic growth patterns will ultimately determine the duration and extent of the current easing cycle. Strong employment data and consumer spending could limit the Fed’s willingness to implement aggressive cuts, while deteriorating conditions might prompt more substantial policy responses.

International economic developments also influence domestic monetary policy decisions. Global growth concerns, trade tensions, and currency movements all factor into Federal Reserve deliberations and market expectations.

The current rate cut cycle presents both opportunities and challenges for investors across all asset classes. While historical precedents suggest positive outcomes for risk assets, careful portfolio management and risk assessment remain essential for navigating the complex dynamics created by changing monetary policy.

Success in this environment requires understanding the transmission mechanisms of monetary policy, recognizing sector rotation patterns, and maintaining appropriate diversification across asset classes and geographic regions. Investors who position themselves thoughtfully can potentially benefit from the market rally sparked by Fed rate cuts while protecting against downside risks that may emerge as conditions evolve.